Ssa1 = Math.Exp(-1.414 * Math.PI / LPPeriod) Hpa1 = Math.Exp(-1.414 * Math.PI / HPPeriod) Public override void Initialize(BarHistory bars) * create indicators and other objects here, this is executed prior to the main trading loop */ Public class TASC202206EhlersLoops : UserStrategyBase Here, Ehlers Loops are superimposed on a chart of Apple (AAPL) in Wealth-Lab 8. Plot(PriceRMS, "Area", #0077FF40, style=plot.style_area) = Normalized Roofing Filter for Volume =//įloat VolHP = butterworthHP(volume, periodHP )įloat Vol = superSmoother( VolHP, periodLP ) = Normalized Roofing Filter for Price =//įloat HP = butterworthHP(source, periodHP )įloat Price = superSmoother( HP, periodLP )įloat PriceRMS = fastRMS( Price, periodRMS) PeriodRMS = input.int( 80, "RMS Period", step=10) PeriodHP = input.int(125, "High-Pass Period", minval=20) PeriodLP = input.int( 20, "Low-Pass Period", minval= 7)

Runtime.error("Err: fastRMS(Period=) is less than 1") SuperSmoother(float Series, float Period) =>įloat sma2 = math.avg(Series, nz(Series, Series))įloat smooth = na, smooth := COEF0 * sma2 +

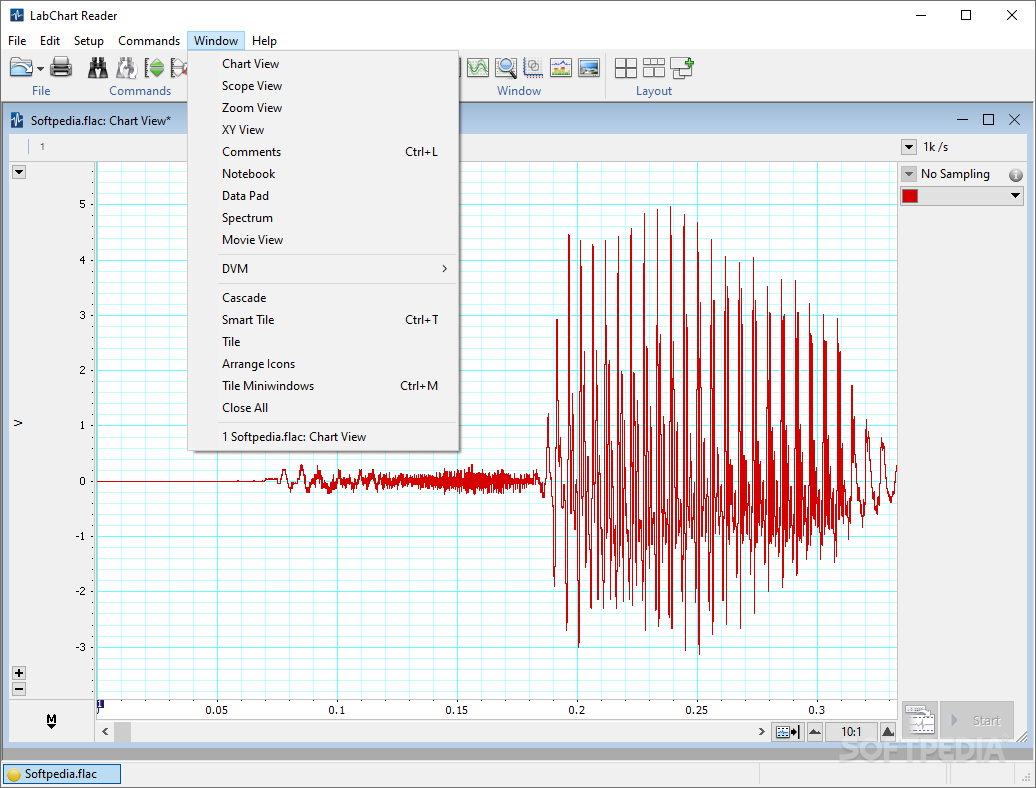

Labchart reader arithmetic smoothing series#

Var float COEF0 = (1.0 + COEF1 - COEF2) * 0.25įloat whiten = Series + nz(Series, tmp) - 2.0 * tmpįloat smooth = na, smooth := COEF0 * whiten + Var float COEF1 = s( ALPHA ) * 2.0 * BETA Var float ALPHA = math.pi * math.sqrt(2.0) / Period = 2 Pole Butterworth Highpass Filter =//īutterworthHP(float Series, float Period) => Provided By: PineCoders, for 2022.06 Ehlers Loops", "ELs", precision=3) Language: TradingView's Pine Script v5

Labchart reader arithmetic smoothing code#

Here is the Pine Script code for TradingView that implements the Ehlers Loops introduced by John Ehlers in his article in this issue. Print( File( "c:\Temp\EhlersLoops.csv" ), Date, ",", Plot3( VolRMS, "VolRMS", VolRMSColor, default, 1 ) Plot2( 0, "Zero", ZeroLineColor, default, 0 )

Plot1( PriceRMS, "PriceRMS", PriceRMSColor, VolHP = hpc1*( Volume - 2 * Volume + Volume ) + PriceRMS = Price / SquareRoot( PriceMS ) HP = hpc1 * ( Close - 2 * Close + Close )

since the keyword "Volume" is used for Volume code is designed for Daily and above bar intervals Note that the code assumes that the export directory “C:\Temp” exists and that the indicator is applied to bar intervals of daily and above. The EasyLanguage given here creates an indicator that can be applied to a TradeStation chart to observe the plots versus price. The author suggests that the resulting Ehlers Loops are a way to discretionarily predict bullish and bearish moves that are based on the curvature and direction of rotation of motion in the price-volume chart. In the analysis, both price and volume are filtered using high-pass and low-pass filters with the result delivering the desired data wavelengths. In his article in this issue, “Ehlers Loops,” John Ehlers presents some concepts of price and volume relationship to determine if any predictive value can be obtained by the analysis.

0 kommentar(er)

0 kommentar(er)